How will your business grow? – Thoughts on estimates and assumptions.

Last Saturday I sat on a panel “Get funded!!” at the Hera Venture Summit. Cathy Pucher of SDSU’s Zahn Center brought up a great point that when an entrepreneur creates financial projections she should identify her assumptions and be ready to explain her rationale to investors or lenders.

Afterwards, an entrepreneur came up to me and joked, “She assumed I knew what an assumption is. What’s an assumption?” It was pretty clear that this entrepreneur wasn’t ready to learn the concept. But for those of you who are let me share my thoughts.

An assumption is a statement that is taken for granted and not questioned. As an entrepreneur you commit a lot of time, money and talent to your business. Do yourself a favor and don’t assume that your business idea is going to catch on quickly and grow exponentially. Question this assumption and even resurrect the scientific method that you learned in grade school. Make your assumptions hypotheses and test them.

What is your growth assumption?

You’ll want to do this because it is extremely common for entrepreneurs and business people to assume their company’s sales and profits will increase significantly immediately. And when the assumption isn’t true the business runs out of cash because you left no room for error. It’s like driving to LA from San Diego and thinking you won’t hit traffic.

One question to address in your business plan is “What is my growth assumption for my business?” As the leader of your company you’ll want to focus on how you’ll work to increase sales and profits and be able to explain it to investors and lenders.

An example I used on the “Get funded!!” panel is one I heard years ago from a friend. She told me that in 1997 Goldman Sachs launched an equity deal for AMF Bowling, which was quite successful. Her firm didn’t participate in the deal, but it’s success came from the assumption that “If just 1% of China’s population picked up bowling – revenues and profits will soar.” and the stock would double if not triple in price. And the deal got done because enough investors invested on the assumption the Chinese population would pick up bowling. They didn’t.

Ultimately, AMF Bowling filed for Chapter 11 bankruptcy protection in 2001. I researched this a bit and found a portion of their Business Strategy from their 79 page S1 registration statement –

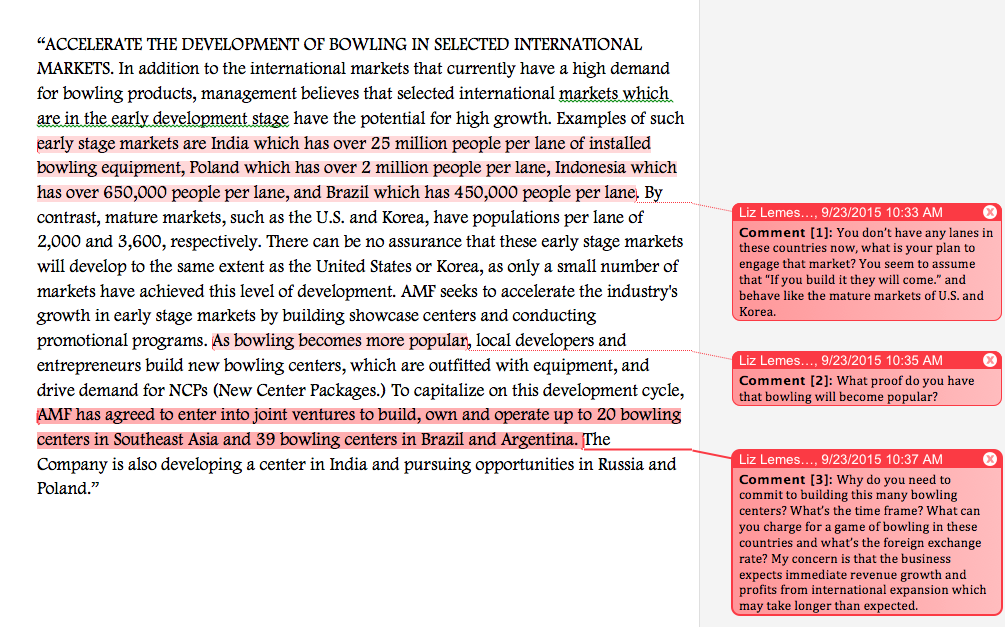

“ACCELERATE THE DEVELOPMENT OF BOWLING IN SELECTED INTERNATIONAL MARKETS. In addition to the international markets that currently have a high demand for bowling products, management believes that selected international markets which are in the early development stage have the potential for high growth. Examples of such early stage markets are India which has over 25 million people per lane of installed bowling equipment, Poland which has over 2 million people per lane, Indonesia which has over 650,000 people per lane, and Brazil which has 450,000 people per lane. By contrast, mature markets, such as the U.S. and Korea, have populations per lane of 2,000 and 3,600, respectively. There can be no assurance that these early stage markets will develop to the same extent as the United States or Korea, as only a small number of markets have achieved this level of development. AMF seeks to accelerate the industry’s growth in early stage markets by building showcase centers and conducting promotional programs. As bowling becomes more popular, local developers and entrepreneurs build new bowling centers, which are outfitted with equipment, and drive demand for NCPs (New Center Packages.) To capitalize on this development cycle, AMF has agreed to enter into joint ventures to build, own and operate up to 20 bowling centers in Southeast Asia and 39 bowling centers in Brazil and Argentina. The Company is also developing a center in India and pursuing opportunities in Russia and Poland.”

Questioning Assumptions

Like many investors you probably skipped over that last paragraph because it looks like gobbledygook. For me, it’s not an easy, fun read but it’s an important read because it answers investment questions that I must ask. What’s the profit opportunity? Is this really the moment that China will adopt bowling? If they do love bowling will it be a fad or will it last? How much money are they investing in this assumption? Below you’ll see my notes in red on how I might have looked at this deal with fresh eyes.

Of course “hindsight is 20-20”, I know that AMF Bowling has filed for Chapter 11 Bankruptcy protection not once, but twice AND I am just an armchair quarterback because I had no skin in the game. Still it’s a good example of assumed growth gone wrong. (Note: I realized that my friend said China but the document said Asia.) If this deal was new and I had money to invest I’d ask myself if these assumptions of implied growth were reasonable. For you as an entrepreneur you may say, “I don’t think about my business that way. I never think in terms of growth or implied growth.” And that may be true but don’t assume that’s how sophisticated investors or lenders think because you’re probably wrong. As an investor, if that’s my job, I assess how much risk I’m taking and if I’m getting paid for the risk. Sophisticated investors invest because they estimate that their equity investment will increase in value. A lender will lend you money because they estimate they will not only receive interest on the loan but also have their principal paid back on time. And both will hope that once this deal is successful there will be more chance for business down the road. Yeah, from time to time you might meet some sophisticated investors who don’t have to report to anyone. They might invest in your business to see other types of beneficial impact in the world. But don’t assume all investors have money to burn.

Of course “hindsight is 20-20”, I know that AMF Bowling has filed for Chapter 11 Bankruptcy protection not once, but twice AND I am just an armchair quarterback because I had no skin in the game. Still it’s a good example of assumed growth gone wrong. (Note: I realized that my friend said China but the document said Asia.) If this deal was new and I had money to invest I’d ask myself if these assumptions of implied growth were reasonable. For you as an entrepreneur you may say, “I don’t think about my business that way. I never think in terms of growth or implied growth.” And that may be true but don’t assume that’s how sophisticated investors or lenders think because you’re probably wrong. As an investor, if that’s my job, I assess how much risk I’m taking and if I’m getting paid for the risk. Sophisticated investors invest because they estimate that their equity investment will increase in value. A lender will lend you money because they estimate they will not only receive interest on the loan but also have their principal paid back on time. And both will hope that once this deal is successful there will be more chance for business down the road. Yeah, from time to time you might meet some sophisticated investors who don’t have to report to anyone. They might invest in your business to see other types of beneficial impact in the world. But don’t assume all investors have money to burn.

AMF Bowling is a good cautionary tale about business assumptions. I suspect that by 1997 it was clear that younger Americans weren’t picking up the sport so the company had to try to grow internationally to stay in business. “India has over 25 million people per lane of installed bowling equipment.” If you run the numbers, assuming management can entice 1-5% of the Indian population to bowl, every year for the next five years. Wow!

This example got a lot of laughs in the room, because now in retrospect it seems silly to assume that bowling could’ve grown in popularity in Asia. But it would be safe to assume that sophisticated investors and lenders have seen at least a thousand deals come across their desks that seem to them just like AMF Bowling. The well-trained ones don’t think in terms of good idea or bad idea. They think “Am I being rewarded for the risk I’m taking.” And you as an entrepreneur have to assure them that yes, they are being rewarded for the risk they are taking. And make sure to tell them how you expect to grow your business’ revenues and profits. That’ll get their attention.