Our Independence Day is coming up on July 4th. And it makes me wonder, what does it mean to be independent? And what does it mean to be financially independent? What’s troublesome and yet delightful is that financial independence is an ideal state. It’s not a destination really, it’s a place that’s not on a map. It’s a place from where you can make choices that are unfettered by excessive debt, excessive government intervention and excessive competition.

Our Independence Day is coming up on July 4th. And it makes me wonder, what does it mean to be independent? And what does it mean to be financially independent? What’s troublesome and yet delightful is that financial independence is an ideal state. It’s not a destination really, it’s a place that’s not on a map. It’s a place from where you can make choices that are unfettered by excessive debt, excessive government intervention and excessive competition.

Since, financial independence is a state beyond what you currently have – it’s really about continual goal setting and measuring your business results against your goals.

“Eternal vigilance is the price of liberty.” ~ John Philpot Curran (early 19th century)

Did you know that only 20% of small businesses set goals? That means that 80% of small businesses don’t have profit goals. Here’s your chance, you can beat the competition by thinking ahead, striving to be financially independent.

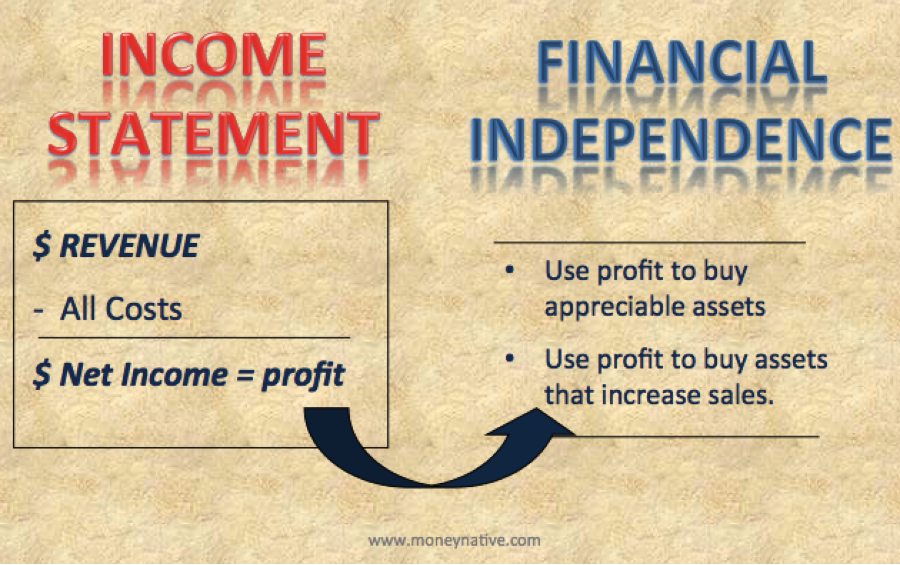

As a small business you only have control over your business decisions. So, keep it simple and find financial independence by keeping an “eternal vigilance” over your income statement. How can you increase sales? How can you cut costs? What should the business invest profits in that has a good chance of making the business more profit? And put projected numbers down in writing in a SMART goal.

Gaining ground on financial independence means you have to have it in your head, and in your heart that business financial independence comes from profit on an income statement. The income statement distills all your hard work into one sheet of paper that dances or weeps to those who know how to read them well. Make your income statement dance with the joy of liberty and plan to be profitable and stick to the plan. In the long run you’ll see that it’s eternal vigilance of the income statement that leads to financial independence.