A friend asked me the other day if I thought it was a good idea for her to buy a rental property. And as always my answer was, “It depends. What are you trying to do?” She had some cash she wanted to invest and she thought that it might be a good idea to buy a rental property to generate income.

When you buy a rental property you:

- diversify the risk of all of your investments. This means that if you have money in the the financial markets and they plummet – you will still have a house that you can touch.

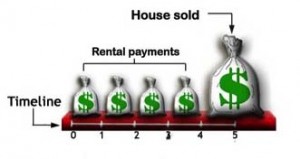

- are creating cash flow that is similar to a bond. (see illustration of cash flows below)

- A bond is a loan to a company or other entity like the government or utility. You buy the bond (loan the company money) and you receive interest payments every six months until the loan comes due (maturity).

- A rental property has similar characteristics. You buy a property and receive rent payments each month until you decide to sell the house.

An alternative strategy:

Check to see if buying individual bonds is a better option because they may provide you higher interest income and less of a headache. Do some research on your own, and then contact your financial advisor to discuss which bonds would have a higher return than a rental property. In the last 10 years it has become much easier for the average person to buy individual bonds and track their value.

These are your cash flows if you buy a rental property: time zero you buy the house, each month receive rent, and when you want you sell the house you receive back your purchase price plus or minus what the housing market dictates. (for simplicity it goes to year 5) Risks include: vacancy rate, housing price risk, ability to sell house

These are your cash flows if you buy a rental property: time zero you buy the house, each month receive rent, and when you want you sell the house you receive back your purchase price plus or minus what the housing market dictates. (for simplicity it goes to year 5) Risks include: vacancy rate, housing price risk, ability to sell house

These are your cash flows if you buy a bond: time zero you buy the bond, every six months you receive interest payments, and when it matures you receive back your purchase price. Or if you sell the bond before maturity you receive back your purchase price plus or minus what the housing market dictates. Risks include: borrower cannot repay loan. Bond market price risk if you need to sell bond before maturity. Ability to sell bond before maturity.